VITA Makes Tax Prep a Breeze for Seton Hall Community - Seton Hall University

Thursday, April 13, 2023

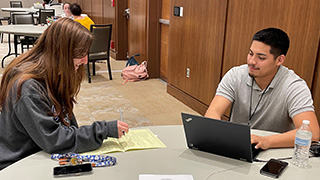

Volunteers from the new Tax Lab course and the United Way assist members of the Seton Hall community with filing this year’s federal and state tax returns.

Tax season can be stressful enough without adding hundreds of dollars in tax preparation

fees to the mix. This spring, for the first time, low- and moderate-income individuals

and families who are part of the Seton Hall community – that's faculty, administration,

staff and students – had the opportunity to take advantage of free tax prep services

right here on the university's South Orange campus.

Thanks to an ongoing partnership between Seton Hall University and the United Way

of Greater Newark and United Way of Northern New Jersey (UWNNJ), a program called

VITA (Volunteer Income Tax Assistance) was brought to campus to provide no-cost tax

return preparation services for those families or individuals with annual household

incomes of up to $75,000.

Students enrolled in a new Tax Lab course this semester, offered by the Stillman School of Business' Department of Accounting and Taxation, were available by appointment and via walk-ins for one-hour sessions in which they sat with qualifying members of the SHU community and – using a software package called TaxSlayer – filed their 2022 federal and state taxes.

Stillman School of Business Tax Lab students originally planned to offer their tax prep services to the Seton Hall community on February 28 and March 28. When a snowstorm forced a rescheduling of the first date to March 14, a day on which a Nor'easter hit the area and squelched attendance once again, the final session on March 28 saw the highest turnout, both with pre-made appointments and walk-ins. Each day initially was to allow a maximum of 20 appointments, which were capped based on the number of volunteers available.

Avery Neumark, J.D., LL.M., C.P.A., and visiting instructor in the Department of Accounting and Taxation, leads the Tax Lab. "The Tax Lab offers our students the perfect blend of academics and practical experience," said Neumark. "What better way to learn?"

Another satisfied customer takes advantage of the complimentary tax prep services offered on campus in March by VITA program volunteers.

"It's important for our students to have experiential learning and to interact with the community," said Senior Faculty Associate Danielle DiMeglio, C.P.A., M.B.A., lecturer and director of graduate programs for the Department of Accounting and Taxation. "It's also nice to host events like this on the Seton Hall campus again – it brings life to the campus that we haven't seen these last few years."

Before enrolling in the Tax Prep course, students at both the undergraduate and graduate levels are required to become IRS-certified. "There are basic and advanced certifications," said Neumark. "Most of our students earned the advanced certification, which not only allows them to do 'intake' and tax preparation, but also to be part of the final quality review process before taxes are filed."

The advantages of the Tax Lab for the 15 undergraduate and graduate students enrolled for this first experimental Spring 2023 semester are many. Students who work with the VITA program perform similar services at local sites within the community, not only on the SHU campus. They gain experience in volunteering, community service and, often, working in underserved communities. Not only that, but the IRS certification also earns them a special badge that can be displayed on their social media profiles – for example, LinkedIn – to benefit their post-graduation job search.

"The Tax Lab also fills a void – offering accounting majors the opportunity to choose an elective that directly supplements their academic program," DiMeglio said.

Anthony Miyamoto, a graduate student in the Master of Science Professional Accounting (M.S.P.A.) program, originally aspired to become a tax accountant and saw the program as a great foot in the door. "I love the program," said Miyamoto, who is in his fifth year with VITA and now serves as a site coordinator. "When I first began volunteering, I was a scholar undergrad with the Educational Opportunity Program (EOP), where I did tutoring and counseling. At the time, my eventual goal was to become a tax preparer."

Danielle DiMeglio, Monica Conover (United Way of Northern NJ), Avery Neumark and Danielle Corea-Smith (United Way of Greater Newark) welcome visitors to the first tax prep session on March 14.

Miyamoto explained that now, as an EOP graduate assistant, his plans have changed. Upon earning his MSPA degree this May, his hope is to be accepted into the doctoral program here at Seton Hall, where he plans to study leadership and policy within higher education. His future aspirations are to become either a full-time EOP advisor or a professor.

The VITA program benefits are significant. "The tax returns filed by VITA program representatives have more than a 97 percent accuracy rate," said Monica Conover, UWNNJ associate director-financial stability and member of the tax prep team. "Something else that gives our program an advantage is that volunteer tax preparation representatives, such as the ones who volunteer through VITA, are required to re-certify annually. The IRS cannot regulate unenrolled paid tax preparers, which means they are not always up to date on current tax law or continuing education." Conover said that annual recertification of VITA program volunteers ensures that they are well versed on any new provisions and tax law changes that occur during the year.

The consensus is that this year's Tax Lab was a success. "We're thrilled to report that, as of mid-April, Seton Hall student volunteers successfully filed 348 free tax returns, resulting in well over $300,000 in refunds issued so far," said DiMeglio.

Categories: Business, Campus Life